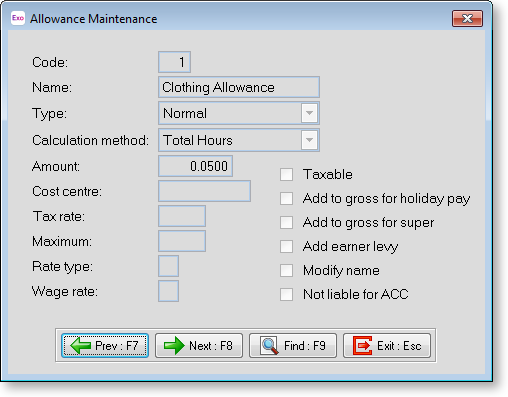

Allowances

This is the main screen for viewing allowance details. All details are read-only as they are set up in MYOB Exo Payroll.

Allowance Code This is the unique code assigned to this allowance.

Name This is the name of the currently selected allowance

Type This setting dictates the type of allowance this is. The type can be one of: Normal, Reimbursement, Withholding Payment and Extra Emolument.

Calculation Method This is how the allowance is calculated and can be one of:

- Fixed Dollar Amount

- Percentage of Wage and Salary

- Total Hours

- Equivalent Hours

- Specific Hours

- Rated Units

- Hourly Rate

- Percentage of Total Gross

Amount This is the amount of the allowance to pay.

Cost Centre This is the cost centre the allowance will be costed to.

Tax Rate This lets the allowance be taxed at a different rate to the employees tax rate.

Maximum This controls the maximum number of units of an allowance that can be paid to an employee.

Rate Type This is the pay rate type assigned to this allowance.

Wage Rate This is the employees' hourly rate that is assigned to this allowance.

Taxable Denotes whether this allowance is taxable or non-taxable.

Add to gross for holiday pay Sets whether this allowance contributes to the employees gross pay that is liable for holiday pay calculations.

Add to gross for super Sets whether this allowance contributes to the employees gross pay that is liable for Superannuation contributions.

Add earner premium Sets whether this allowance contributes to the employees gross pay that is liable for earner premium.

Modify name Allows user to modify the name of the allowance when paying it to an employee.

Not liable for ACC Marks whether this allowance is liable for ACC employer premium or not.