Sales > Receiving payments

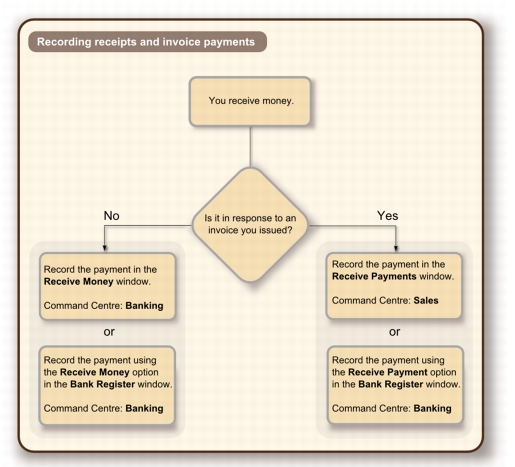

When customers make payments against invoices, you record the payments in the Receive Payments window. You can record the payments against one or more of the customer’s outstanding invoices. If you don’t want to create an invoice for a customer, you can enter the customer payment in the Receive Money window. See Receiving money.

You can also record payments from your customers in the Bank Register window. If you have several customer payments and you don’t want to record detailed information (such as payment methods and discounts) for each payment, the Bank Register window can save you time. Note that when you use the Bank Register window for customer payments, the entire payment is automatically allocated to the oldest invoices first. For more information, see Entering transactions in the Bank Register window.

If customers make payments when purchasing merchandise or services and you are issuing them an invoice, you can type the payment amount in the Paid Today field of the invoice. See Enter additional information about the sale.

The options for recording receipts and invoice payments are summarised in the following diagram.

To record payments against invoices

|

1

|

|

▪

|

Deposit to Account. Select this option and select the required bank account.

|

|

▪

|

Group with Undeposited Funds. Select this option if you want the deposit to be recorded in the undeposited funds account. After you have grouped all the deposit transactions you want, you can then make a bank deposit. For more information about undeposited funds and preparing bank deposits, see Bank deposits.

|

|

3

|

In the Customer field, type or select the customer’s name.

|

If you have no record of any sales to this customer, a message window appears. Click OK and ensure you’ve selected the correct customer.

|

5

|

If you want to record the payment method, select the method in the Payment Method field. Click Details if you want to enter further details about the payment. For example, if you are being paid by credit card, you can record the credit card number and expiry date.

|

|

6

|

If you want, adjust the memo and payment date. You can change the ID number that is automatically generated. However, we recommend that you use the default number to make sure you don’t use duplicate IDs.

|

|

7

|

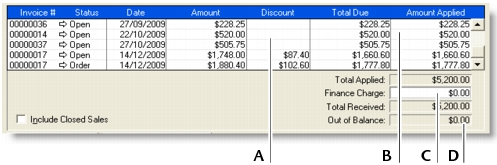

In the scrolling list in the bottom half of the window, indicate which sales are covered by the payment by entering amounts in the Amount Applied column. If the customer is paying a deposit for an order, look for Order in the Status column.

|

|

If you intend to offer an early-payment discount for a sale, assign the discount to the appropriate invoice in this column. Note that you won’t be able to assign a discount to an invoice that is not being settled in full. If this is the case, you can give them a customer credit note. See Customer credits.

|

||

|

Amount Applied

|

Enter how much of the payment you want to apply to each sale in this column.

|

|

|

Finance Charge

|

If part of the payment is to pay finance charges, type the finance charge amount here. For more information, see Finance charges paid by customers.

|

|

|

Out of Balance

|

The amount you apply in the Amount Applied column accumulates in the Total Applied field. The Total Applied amount (plus finance charges) must equal the amount that appears in the Amount Received field in the top half of the window before you can record the transaction. The Out of Balance amount must be zero before you can record the transaction.

|

|

If a customer overpays, you should still enter the amount received. The full payment should be entered in the Amount Received field and in the Amount Applied column in the scrolling list. When you record the payment, a credit invoice for the overpaid amount is created automatically. This can either be refunded to the customer or applied to a future invoice. For more details, see Settling credits.

|

8

|

Click Record.

|