M-Powered Invoices > What are M-Powered Invoices?

M-Powered Invoices is a service that enables you to generate invoices and statements that offer your customers an extended range of payment methods. It also provides a convenient and secure method of receiving and recording customer payments.

|

▪

|

|

▪

|

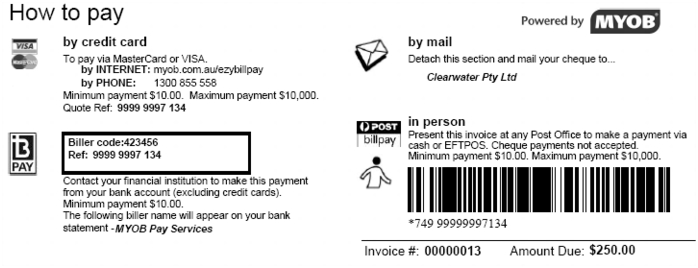

Credit Card: Customers can pay you using a credit card either by an automated phone system or visiting a website on the Internet. Your customers can use VISA or MasterCard.

|

|

▪

|

POSTbillpay in person: Customers can pay your invoices and statements at any Australia Post outlet. Your customers can pay in cash or by EFTPOS.

|

® Registered to Bpay Pty Ltd ABN 69 079 137 518

|

▪

|

More payment options for your customers: By offering your customers a wide range of payment methods—some of which can be accessed 24 hours a day, seven days a week—it’s easier for your customers to pay you, and pay you on time.

|

|

▪

|

Improved cashflow: By making it easier for your customers to pay you the way they want—and by reducing the time it takes for their money to arrive in your account—you can get your money faster, improving your cashflow.

|

|

▪

|

Reduced payment processing time and cost: Because payments are automatically deposited into your business bank account as cleared funds, there’s no need to waste time writing up cheque payments, processing credit cards or queuing at the bank.

|

|

▪

|

More secure payments: By having customer payments credited directly to your business bank account, M-Powered Invoices reduce the security risks associated with cash and cheque handling, as well as the potential for fraud.

|

|

▪

|

Paying you the way they want to: By using M-Powered Invoices, your customers can pay you in a way that suits them: through Bpay, by Credit Card (by calling a 1300 phone line or visiting myob.com.au/ezybillpay), or by paying over the counter at any one of 3900 Australia Post outlets, in addition to the other payment methods your business is currently offering.

|

|

▪

|

An alternative to cheques: It is often said that small businesses prefer to pay by cheque. Yet, in recent years cheque usage in Australia has declined. Many find the process of writing and recording cheques tedious. And from a customer’s point of view, not knowing whether a cheque has been presented is a further disincentive to pay by cheque.

|

|

▪

|

Easier payment scheduling: If your customers are paying your invoices through Bpay online, they have the option to pay immediately, or on some future date (such as the due date).

|

|

▪

|

Security: M-Powered Invoices payment methods offer a high level of security. Receipt numbers are issued for all transactions made using the service, and your customers don’t have to worry about carrying large quantities of cash, or have concerns about cheques going astray.

|

|

▪

|

Cost savings: MYOB does not charge your customers for using M-Powered Invoices to pay you. Also, by paying electronically, they can save on postage and cheque fees—as well as save time and effort with their own accounts processing.

|

|

1

|

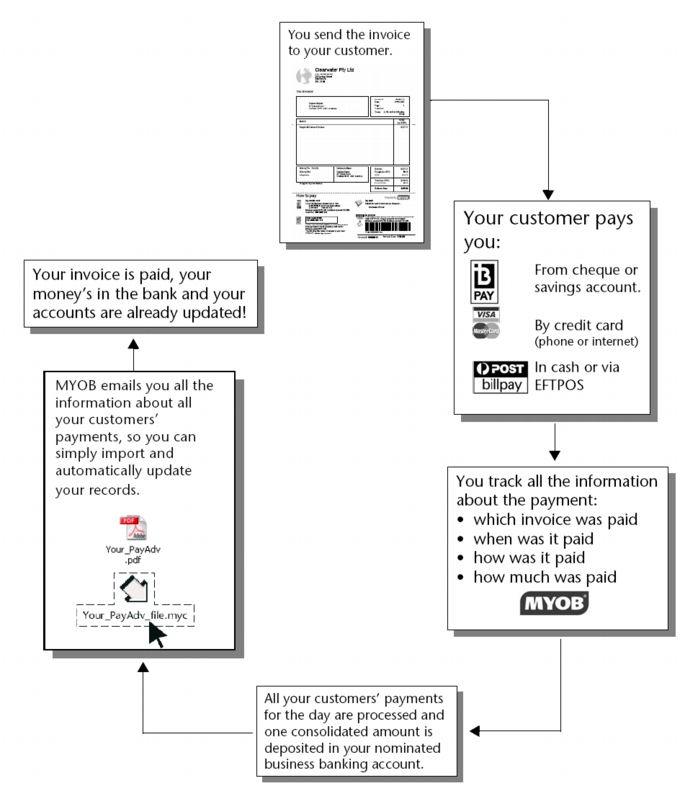

You generate invoices or statements using your MYOB software and send them to your customers. M-Powered invoice and statement forms are different from ordinary forms in that they have a specific How to pay section that contains icons for the additional payment methods.

|

|

2

|

Your customer pays the M-Powered invoice or statement using one of the payment methods offered, such as Credit Card, Bpay or POSTbillpay in person.

|

|

5

|

M-Powered Services instruct our sponsoring bank to transfer funds to your nominated business bank account.

|

|

6

|

A Payment Advice (with the extension ‘.pdf’) and a payment file (with the extension ‘.myc’) are emailed to you each business day detailing all payments made by your customers and the total amount is credited to your business bank account.

|

|

7

|

Record your customer payments in your company file. You can do this manually (see Recording M-Powered invoice payments manually), or, if you use MYOB software on Windows, you can do this automatically using M-Powered Import Assist (see Importing customer payments using M-Powered Import Assist).

|