|

1

|

|

5

|

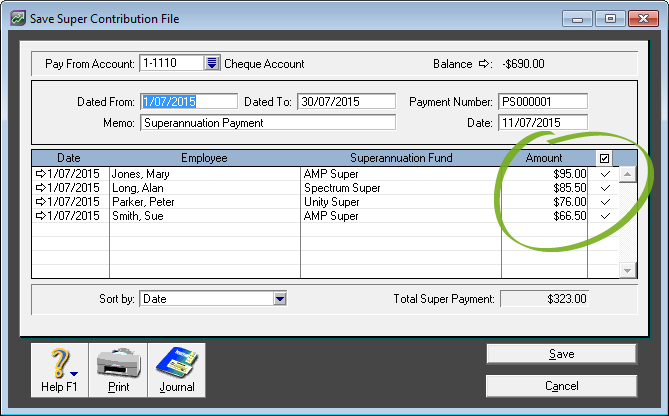

note: Do you have employees with different pay frequencies, or who started or left during the period? When creating a super contribution file, you should only include contributions for employees who were paid for the exact same payroll period.

If all your employees were paid on the same dates, and nobody started or left the business during the period you’re reporting for, you can include all contributions in one super contribution file. Otherwise, you’ll need to create multiple files. For example, assume you’re making super payments for July. All your employees were paid fortnightly (14/7, 28/7), except for two who were paid monthly (15/7). You should save a separate contribution file for the two monthly employees. This will ensure that the correct payroll period is reported to all employee funds. The payroll period for the fortnightly employees would be reported as 1 July – 28 July, while for the monthly employees it would be 16 June – 15 July. |

|

7

|

|

9

|