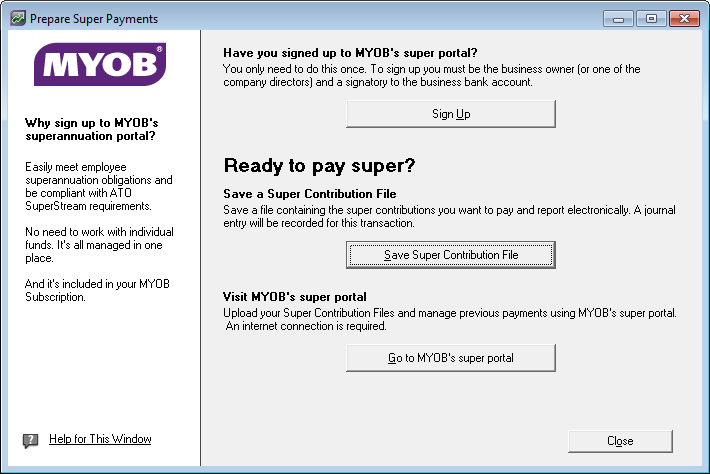

To do this, click Pay Superannuation in the Payroll command centre, and then click Sign Up. Note that only the business owner, or one of the company directors, who is a signatory to the business bank account can sign up. You'll only need to do this once.

In AccountRight, check the setup of your:

|

▪

|

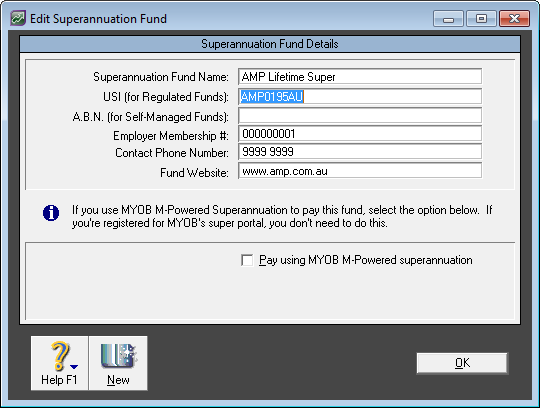

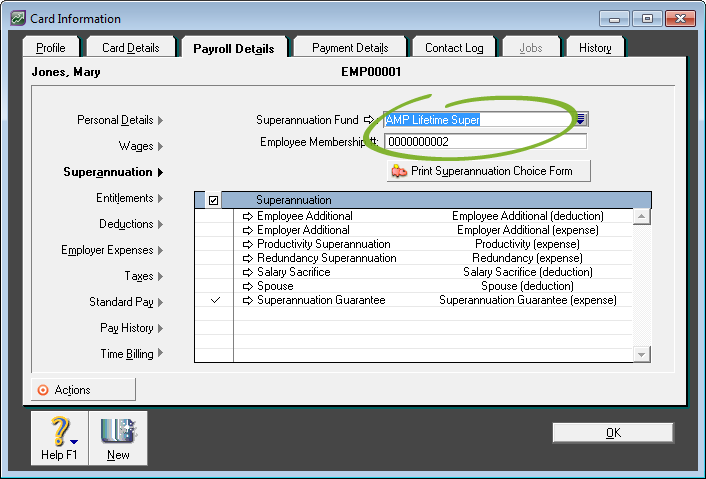

Super funds: Go to the Lists menu and choose Superannuation Funds. Review each super fund in the list. For each APRA-regulated super fund, enter the fund's Unique Superannuation Identifier (USI). If there are self-managed funds, enter the fund's ABN. If you don't know these details, contact your super fund or employee.

Note that if you were previously using M-Powered Superannuation, you need to deselect the Pay using MYOB M-Powered Superannuation checkbox. |

|

▪

|

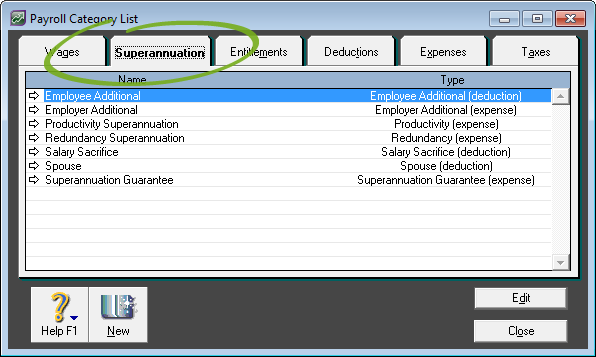

Super categories: Check that the super categories you're using are of the Superannuation type, not Employer Expense. If your employees are currently linked to Employer Expense categories, you need to create new superannuation categories and link the employees to them.

Also see our support note explaining how to transfer unpaid super that was tracked using the expense category to the Superannuation category.

note: Spouse contributions

Note that spouse super contributions can't be paid using MYOB's super portal.

|

|

▪

|

There are a few more things you should know and do in your software before you make a superannuation payment. For all the details, click here.

When it's time to make your super contributions, click Pay Superannuation in the Payroll command centre and then click Save Super Contribution File. Use the Save Super Contribution File window to select the super amounts you want to pay and to save a text file to your desktop that has the information required to process the superannuation payments. When you save the file, a journal entry will also be recorded for the transaction.

Once you've saved the super contribution file, upload it to MYOB's super portal. The first time you upload the super contribution file you might need to add some additional employee and banking information into the portal.