FBT Calculator

The Fringe Benefit Tax Calculator is a utility that helps you start the process of filling out your quarterly Fringe Benefit Tax payable, under the Alternate Rate calculation method (formerly known as the Multi-rate method). From the Utilities Menu, select FBT Calculator.

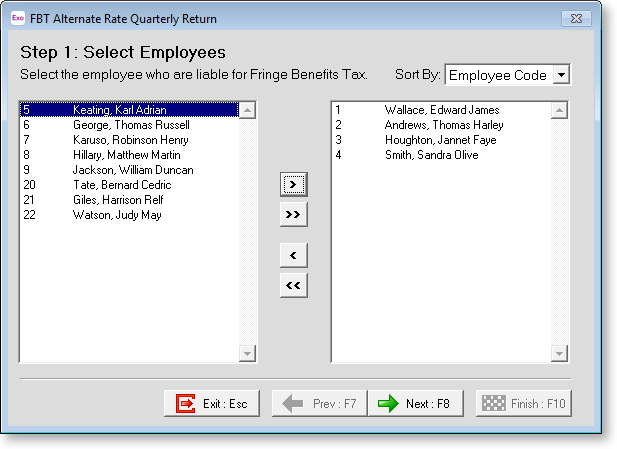

Step 1: Select Employees

To move an employee from the Available window to the Selected window, click on the employee then click the > button. To select all employees (recommended) click the >> button.

Click Next or press F8 to continue.

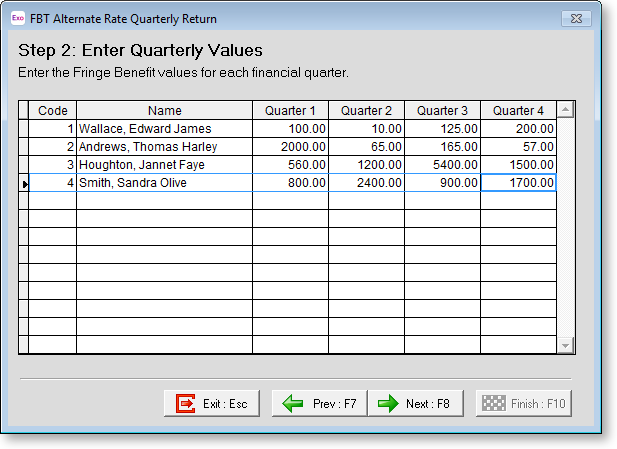

Step 2: Enter Quarterly Values

Click into the grid to enter your data. Key in the fringe benefit amounts and press the arrow keys up/down to navigate around the grid.

Click Next or press F8 when you are ready to generate the return.

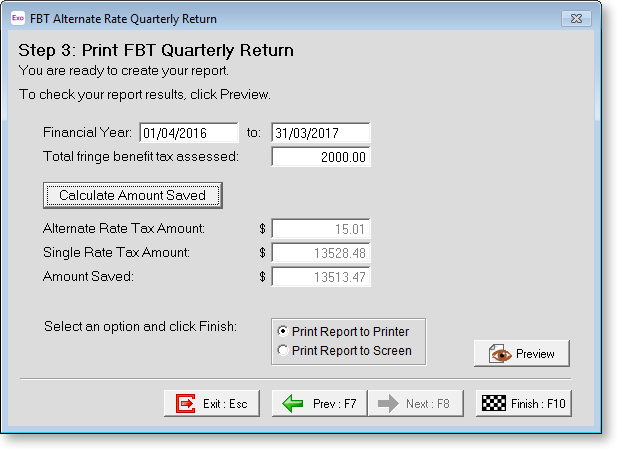

Step 3: Print FBT Quarterly Return

Financial Year Enter the date range that the return covers.

Total Fringe Benefit Tax Assessed If an amount has already been assessed, enter it here. The assessed tax will be subtracted from the FBT payable for the year to form the Alternate Tax Rate Amount to pay.

Click the Calculate Amount Saved button to calculate the tax amounts:

-

Alternate Rate Tax Amount - The FBT amount, calculated via the Alternate Rate calculation method. This is the amount that will appear on the report.

-

Single Rate Tax Amount - This field shows what the FBT amount would be if the Single Rate method (formerly the Flat Rate method) were used.

-

Amount Saved - This field shows the amount saved by using the Alternate Rate method instead of the Single Rate method.

Print Report to Set the report to generate to screen, or directly to the printer, when the Finish button is pressed.

Preview This generates the report to screen, for final checking.

Click Finish to output the report to the required destination. The report will incorporate the employees' income and assessed income tax plus fringe benefits, into the FBT calculations.